The fact that you talk about this in terms of "owing society" says that you view progressive taxation as the wealthier somehow "paying more than their fair share" and basically subsidizing all those who don't shit gold like they do.Originally Posted by Kblaze8855

They deserve to pay more because they benefit more from the system that allows them to make more money than the rest of us. The arenas that these NBA superstars play in are heavily subsidized by local taxpayer money. Business owners benefit from the infrastructure that provides them with competent employees, be it via decent public schooling, roads, mass transit, etc. Some of them make a killing leeching off the system that is rigged in their favor because their lobbyists are legally allowed to bribe our politicians.

Who said I did? I said that to assert that people are generally too ignorant and/or lacking curiosity simply because it was way before their time.Really? You think you are the one who informed modern society of the tax laws of generations ago?

It's quite obvious that you've clearly never had a conversation with "everyone" who's ever talked taxes.Everyone who ever had a tax discussion knew that taxes used to be much higher. Who could you possibly think didnt know that?

People simply having tax discussions doesn't necessarily make them any better informed about them. I still occasionally run in to ignoramuses (on MBs like this one) who claim to have been working and paying taxes for years say, "I don't want to make X5,000 dollars. I'd rather make X4,999 dollars because I'll get to pay less in taxes" because they have no clue about how tax brackets work.

Most people only talk about them in reference to the recent past and the here-and-now and really couldn't give two shits about how things were back when they were too young to have paid taxes or not born yet.

Another reason why the rich should be taxed much higher is very simple. Middle class and poor people spend most of their money just to get by. Rich people generally hoard it. When you concentrate more wealth at the top, money doesn't flow and the economy suffers. The Trump presidency has basically delayed the economic cycle (recession) by increasing government spending and handing out massive corporate tax cuts. FYI, the tax cuts aren't doing shit.Case by case. There is a point at which I wouldnt keep putting in the effort to only bring home a third of what I make from that point on. It would depend on the job and how rich I already was.

https://www.nytimes.com/2019/01/01/o...uve-heard.html

For those too lazy to read, here are some of the biggest takeaways from the massive corporate tax cut:

Paul Krugman might not be to some peoples' taste, but then again those schlubs aren't Nobel laureates who know wtf they're talking about.

The key point to realize is that in today’s globalized corporate system, a lot of any country’s corporate sector, our own very much included, is actually owned by foreigners, either directly because corporations here are foreign subsidiaries, or indirectly because foreigners own American stocks. Indeed, roughly a third of U.S. corporate profits basically flow to foreign nationals – which means that a third of the tax cut flowed abroad, rather than staying at home. This probably outweighs any positive effect on GDP growth. So the tax cut probably made America poorer, not richer.

And it certainly made most Americans poorer. While 2/3 of the corporate tax cut may have gone to U.S. residents, 84 percent of stocks are held by the wealthiest 10 percent of the population. Everyone else will see hardly any benefit.

Meanwhile, since the tax cut isn’t paying for itself, it will eventually have to be paid for some other way – either by raising other taxes, or by cutting spending on programs people value. The cost of these hikes or cuts will be much less concentrated on the top 10 percent than the benefit of the original tax cut. So it’s a near-certainty that the vast majority of Americans will be worse off thanks to Trump’s only major legislative success.

Already addressed.You dont make people richer by letting them keep their money. I dont know where people got the idea that its doing someone a favor to take less of their money. It isnt. Its their money to begin with. They are supposed to get richer when they keep generating it. Why on earth would I want to prevent someone from possessing what they earn? They money isnt being pulled from my childrens mouth. They get the money the same way anyone does. Other people giving it to them. Depending on the industry it it could be a few people...or millions giving a penny here and there...but they are given the money by society. It isnt stolen. That they use that money to make more money is none of my concern.

If GE is successful and making money, why do they deserve to pay no taxes? Just because their employees pay taxes? That's probably the stupidest excuse I've ever heard to justify a large company paying zero corporate income tax.GE employs 300+ thousand people without another 200 thousand in support companies indirectly. Ge is paying this planet in a thousand ways. How many things do you think get taxed before a generator that powers a quarter million homes is built and installed in a power plant? How much gas...shipping...how much material is bought...how many people pay income tax from the salary Gm pays...how much land is purchased...how many things must property taxes be paid on? Just so happens the largest turbine plant they have in the world is literally up the street from me. I live in greenville south carolina as many here have heard me say before. Do you know how well GM pays? Ive known people working there all my life. My friends parents were making 30 dolllars an hour in the early 90s. Who knows what it is now.

Ge generates massive tax revenue in a dozen ways. You cant run a company of that size for free. You cant do anything for free.

If you're done bloviating on that soap box, you might ask yourself what options people working in mom-n-pop grocery/hardware stores have when Walmart rolls into their smallish rural city/town.And the living wage shit is hilarious to me.

-snipped for brevity

http://time.com/money/4192512/walmar...g-small-towns/

And then in some cases, pack up shop and leave after ruining the local businesses and economy. What do you tell the guy who closed up shop and wound up working for Walmart (when he could no longer compete with them) only to lose his job a few years later? Move out of his little shithole town that he grew up in and settled in to go find a real job in some bigger city?

Yeah, I know that not everyone working at Walmart fits the above narrative. My whole point about Walmart is that they're a leech on the system.

Results 61 to 75 of 108

-

01-23-2019, 09:31 PM #61Local High School Star

- Join Date

- Jan 2008

- Posts

- 1,921

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Last edited by greymatter; 01-23-2019 at 09:36 PM.

-

01-23-2019, 09:43 PM #62

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

The ignoring in this thread by some people of the pure luck of what kind of situation you are born into and with specific genes you have... is pretty absurd.

And, there simply has to be some redistribution of wealth at some point because even the wealthiest people would agree that some version of wealth inequality ruins society for them as well...

Some form of a progressive tax rate makes sense in theory, but as many have pointed out...the wealthy will often find ways to shield their money as best they can.

That is why philosophical education is paramount in my opinion. If people were educated about the illusion of libertarian free will and were able to adopt a more rational compassion...we wouldn't view this life in such a selfish manner and realize that we are all in this together...and actually live like that...rather than just say it.

And, yes, taxing the ultra wealthy a bit more is one piece of fixing some of these problems, but they have to willingly agree to it...and want to do it...otherwise it won't have the societal impact it could...

As an aside...pretty much agree with everything greymatter stated aboveLast edited by DMAVS41; 01-23-2019 at 09:48 PM.

-

01-23-2019, 09:53 PM #63Local High School Star

- Join Date

- Jan 2008

- Posts

- 1,921

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Good luck ever trying to gut SS and military spending. I'm ok with SS because at least you pay into it and (hopefully) get it back. The military has a shitty ROI and is a massive drain on our economy. Look no further than the epitome of bloated budget and behind schedule.....the F-35. Only costs 1.5 trillion over its scheduled lifetime of service.

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Good luck ever trying to gut SS and military spending. I'm ok with SS because at least you pay into it and (hopefully) get it back. The military has a shitty ROI and is a massive drain on our economy. Look no further than the epitome of bloated budget and behind schedule.....the F-35. Only costs 1.5 trillion over its scheduled lifetime of service. Originally Posted by Ben Simmons 25

Originally Posted by Ben Simmons 25

Last edited by greymatter; 01-23-2019 at 09:56 PM.

-

01-23-2019, 09:56 PM #64

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Originally Posted by Kblaze8855

Originally Posted by Kblaze8855

One of the more ignorant and surface level comments on the topic.

Do some research on just how ****ed you are in this society with certain levels of general intelligence without being lucky enough to have great family / friend support.

-

01-23-2019, 10:06 PM #65Local High School Star

- Join Date

- Jan 2008

- Posts

- 1,921

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

I'd comfortably wager that there's about a 0% chance that you'd know off-hand (that means without looking it up) what the top income tax brackets were changed to during the Reagan to Bush to Clinton eras (1980 --> 2000).

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

I'd comfortably wager that there's about a 0% chance that you'd know off-hand (that means without looking it up) what the top income tax brackets were changed to during the Reagan to Bush to Clinton eras (1980 --> 2000). Originally Posted by Hawker

Originally Posted by Hawker

-

01-23-2019, 11:30 PM #66NBA Legend and Hall of Famer

- Join Date

- Jun 2006

- Posts

- 19,687

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

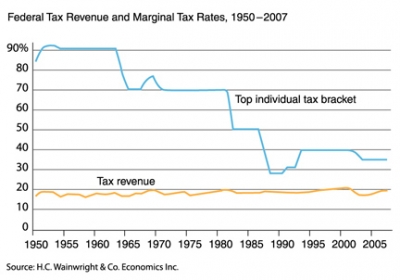

It doesn't matter. Tax receipts have stayed the same. You know how to read a graph right? You're ignorant to the change of tax laws in the first place...loopholes, deductions and special privileges were taken away in exchange for a much lower tax rate. Nobody ever paid those rates so continue to repeat like an idiot where tax rates were in the past with no detail does a disservice to everyone. You're not telling the full story.

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

It doesn't matter. Tax receipts have stayed the same. You know how to read a graph right? You're ignorant to the change of tax laws in the first place...loopholes, deductions and special privileges were taken away in exchange for a much lower tax rate. Nobody ever paid those rates so continue to repeat like an idiot where tax rates were in the past with no detail does a disservice to everyone. You're not telling the full story. Originally Posted by greymatter

Originally Posted by greymatter

Imagine being so illiterate that you think tax cuts are an expense to be paid for.

-

01-24-2019, 12:00 AM #67

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Here's what you're missing...the wealthy and politically powerful whether you want to talk about private citizens, companies, industries or whoever through lobbying, lawmaking, political donations, industry cartels and countless other methods...have shaped and structured society and laws over time through their privilege to leverage and skewer it heavily in their favor whether it's through taxes, regulations, monopolies etc. so that their wealth and power accumulation grows exponentially without reason:When someone cant understand why people who arent rich dont want the rich to be taxed even more....seems they cant grasp the reasoning. Some people arent only thinking of themselves. I'll never make 10 million a year. Doesnt mean the people who do owe society more money

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Here's what you're missing...the wealthy and politically powerful whether you want to talk about private citizens, companies, industries or whoever through lobbying, lawmaking, political donations, industry cartels and countless other methods...have shaped and structured society and laws over time through their privilege to leverage and skewer it heavily in their favor whether it's through taxes, regulations, monopolies etc. so that their wealth and power accumulation grows exponentially without reason:When someone cant understand why people who arent rich dont want the rich to be taxed even more....seems they cant grasp the reasoning. Some people arent only thinking of themselves. I'll never make 10 million a year. Doesnt mean the people who do owe society more money

Inside the Secretive World of Tax-Avoidance ExpertsThe 1% grabbed 82% of all wealth created in 2017Oxfam: World's richest 26 own same wealth as poorest halfhttps://www.theatlantic.com/business...gement/410842/World's 26 richest people own as much as poorest 50%, says Oxfam

Charity calls for 1% wealth tax, saying it would raise enough to educate every child not in school

https://money.cnn.com/2018/01/21/new...lth/index.html

https://www.aljazeera.com/news/2019/...054249908.html

https://www.theguardian.com/business...t-oxfam-report

https://www.oxfam.org/en/pressroom/p...ated-last-year

https://www.cnbc.com/2019/01/21/oxfa...s-richest.html

So this thing about "the rich and wealthy should keep what they earned *fair and square*" isn't really what you think it is, because they didn't accumulate it fair and square, much of it is gaming and manipulating the system over time.

America is run by corporations and lobbies, and it's even worse in many other parts of the world.

-

01-24-2019, 12:18 AM #68World Champion WOOOO~!

- Join Date

- Jun 2007

- Location

- Land of 15 NBA Championships

- Posts

- 768

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

I don't understand the idea some have that all rich ppl dont pay their fair share of taxes. I mean, 37% of 100 million is a much larger amount than 22% of 50k, yet that is still not enough. 70% is an absurd amount to pay and it is immoral to expect anyone to give that percentage of their income to a government that has proven itself incapable of responsible spending, especially when the government isnt exacty transparent with how your money is being spent. Clearly alot of these politicians have the budgeting discipline of a spouse who consistently drains the checking account to buy frivelous sh**t.

Socialists like AOC are excellent at creating identity groups to divide and conquer US citizens. The nordic countries tax their middle class at around 50-60%, but these US socialists know that won't fly here so they just demonize the wealthy to galvanize support to rob them. If you're going to tax the rich 70%, tax everyone 70% - that's the only fair way to do it. However, I expect that most Americans would riot before they allow some dumb ish like that to go down.

As kblaze said, reaching middle class status is not difficult to do in this country.

1. Don't have kids out of wedlock that you cannot afford.

2. Don't commit a felony.

3. If you go to college, don't pay 50k plus on a degree that doesnt have economic value.

4. Stop being lazy and use that fancy, expensive iphone that you can't afford to research skills that are in demand. Rich ppl use this very same logic when building their businesses and that is why they make a killing. There are so many trades such as plumbing that are in demand and can pay 60-100k with a few years of experience. You dont even need a college degree to do this stuff.

5. Have discipline when it comes to spending.

-

01-24-2019, 12:42 AM #69Local High School Star

- Join Date

- Jan 2008

- Posts

- 1,921

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Add another wager that you're one of those "special" people who are dumb enough to buy Heritage Foundation Reagonomics tardshit like "tax cuts increase revenue".

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Add another wager that you're one of those "special" people who are dumb enough to buy Heritage Foundation Reagonomics tardshit like "tax cuts increase revenue". Originally Posted by Hawker

Originally Posted by Hawker

-

01-24-2019, 12:48 AM #70Local High School Star

- Join Date

- Jan 2008

- Posts

- 1,921

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

In case you're too slow to understand my response, I'll simplify it for you.

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

In case you're too slow to understand my response, I'll simplify it for you. Originally Posted by Hawker

Originally Posted by Hawker

You've done nothing but regurgitate oft-debunked (by literally every economist who isn't a complete retard) standard Reaganomics apologist talking points that the likes of Heritage Foundation puts out for people like yourself.

-

01-24-2019, 12:49 AM #71

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Originally Posted by Tainted Sword

Originally Posted by Tainted Sword

That is all "easy" if you are born with suitable broad level intelligence and into decent circumstances with two parents...etc.

Unfortunately, many people are born (and certainly didn't ask to be born at all) into situations that produce humans that aren't capable of the above. It produces dumb, overwhelmed, and unhealthy individuals that need a lot of help.

Is our country the best? Yep.

Is capitalism the best system? Yep.

But we can and should do better given the resources we have.

And, of course, money alone isn't fixing this...it will take a culture shift. But money is usually the best way to facilitate the type of wide sweeping change we need in this country to reduce people from entering the world with the genes and circumstances that reliably produce what we see.

I agree with your list above in terms of a good guide for doing well in America...my point is that when the numbers get to where they are...it is kind of hard to blame individuals...

Something much bigger and deeper is going on here when so many people can't do things that intelligent people find trivially easy.

The truth is that intelligent people are often quite ignorant to just how stupid a lot of people are and just how hard it is for them to have things like "discipline" and "common sense"...

-

01-24-2019, 01:02 AM #72NBA Legend and Hall of Famer

- Join Date

- Jun 2006

- Posts

- 19,687

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Numbers don't lie buddy. Straight from the CBO. It's called Hauser's law. Laffer curve as well highlights taxation can only go so far (another economist).

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Numbers don't lie buddy. Straight from the CBO. It's called Hauser's law. Laffer curve as well highlights taxation can only go so far (another economist). Originally Posted by greymatter

Originally Posted by greymatter

Keynesian economists aren't the only economists out there. You have monetarists and austrians...keynesians just get way more publicity and is what is taught in the 10th grade textbooks.

As to your point about Wal-mart, I bet there were a lot of people in those rural towns that liked they could get their goods at 9-10pm at night. Mom and pop places don't stay open that late and usually don't have near the selection Wal-mart would. Stop being so short sighted.Last edited by Hawker; 01-24-2019 at 01:08 AM.

-

01-24-2019, 01:39 AM #73World Champion WOOOO~!

- Join Date

- Jun 2007

- Location

- Land of 15 NBA Championships

- Posts

- 768

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

I try to avoid having the mindset that such a broad and diverse demographic in this country are so dumb and incapable of taking care of themselves that it is the sacred duty of the government to care for them as if they were a bunch of invalids. I feel that is an elitist way to view things.

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

I try to avoid having the mindset that such a broad and diverse demographic in this country are so dumb and incapable of taking care of themselves that it is the sacred duty of the government to care for them as if they were a bunch of invalids. I feel that is an elitist way to view things. Originally Posted by DMAVS41

Originally Posted by DMAVS41

I blame the lack of knowledge you speak of on the education system. We pump more money than almost any other nation into it and it consistently fails to produce quality results. The only solution most politicians have is to pump more dough into it which is the very definition of insanity. Spending more on public education without addressing the systemic flaws that are failing children today is like someone repeatly investing in penny stocks with the hopes of striking rich. I think the tax revenue the government currently generates would go a long way if these politicians were more responsible with their spending and were held to the same management standards as an executive.

1. Civics should be taught every year beginning in jr high and students should be required to pass a civics exam before graduation.

2. Simple budgeting and financial classes should be taught every year starting in hs.

3. School counselors need to stop pushing college as the end all be all and students should be educated about the trade options that are available as well. As I said, there are alot of trade skills that are in demand and that currently have severe shortages now that boomers are retiring. Becoming a plumber or electrician is preferable to trying to make a career out of working at walmart.

4. There needs to be an emphasis on teaching these trades in hs like back in the day.

-

01-24-2019, 02:00 AM #74Local High School Star

- Join Date

- Jan 2008

- Posts

- 1,921

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

https://www.youtube.com/watch?v=ZPHSXUS0_1c

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

https://www.youtube.com/watch?v=ZPHSXUS0_1c Originally Posted by DMAVS41

Originally Posted by DMAVS41

Aside from the above, the only things I'll say the US is bar none the best at is hemorrhaging money on military spending, bending over its citizens on health care costs, and producing the world's best basketball players.

The US, like many others, has a "mixed economic" system. Never been "pure" capitalist.Is capitalism the best system? Yep.

The most politically astute (and often most sardonic and/or pessimistic) individuals I come across on other MBs generally express the sentiment that "we get the government we deserve".But we can and should do better given the resources we have.

And, of course, money alone isn't fixing this...it will take a culture shift. But money is usually the best way to facilitate the type of wide sweeping change we need in this country to reduce people from entering the world with the genes and circumstances that reliably produce what we see.

I agree with your list above in terms of a good guide for doing well in America...my point is that when the numbers get to where they are...it is kind of hard to blame individuals...

Something much bigger and deeper is going on here when so many people can't do things that intelligent people find trivially easy.

The truth is that intelligent people are often quite ignorant to just how stupid a lot of people are and just how hard it is for them to have things like "discipline" and "common sense"...

-

01-24-2019, 03:46 AM #75Local High School Star

- Join Date

- Jan 2008

- Posts

- 1,921

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Your numbers don't say what you imagine them to say. Revenue went down the year after Reagan dropped the top bracket from 70 to 50%. He offset the revenue decrease by raising payroll taxes, which surprise surprise, affected middle class small business owners more than the rich. The only reason why revenues didn't go down after his next top bracket drop in 1986 (50 -> 28) was because the economy was booming by then and his tax increases elsewhere were more than enough to offset it. HW Bush was forced to renege on his campaign promise to not raise taxes because he was responsible enough to deem that Reagan's massive deficits were unsustainable, causing him to be a 1 termer.

Re: Imagine what the proposed(but unlikely) tax plan would do to the NBA.

Your numbers don't say what you imagine them to say. Revenue went down the year after Reagan dropped the top bracket from 70 to 50%. He offset the revenue decrease by raising payroll taxes, which surprise surprise, affected middle class small business owners more than the rich. The only reason why revenues didn't go down after his next top bracket drop in 1986 (50 -> 28) was because the economy was booming by then and his tax increases elsewhere were more than enough to offset it. HW Bush was forced to renege on his campaign promise to not raise taxes because he was responsible enough to deem that Reagan's massive deficits were unsustainable, causing him to be a 1 termer. Originally Posted by Hawker

Originally Posted by Hawker

Bottom line is that trickle-down theory is for dipshits.

https://www.bloomberg.com/opinion/ar...s-of-1982-1993

Revenue also declined immediately after W's tax cuts. While some of it could be attributed to the dotcom burst, his tax cuts didn't generate any increased revenue. Tax revenue didn't get back to 2001 levels until the GDP grew 10+% higher (than 2001 levels) by 2005. Yet another proven failure of trickle down theory.

[quote]

Keynesian economists aren't the only economists out there. You have monetarists and austrians...keynesians just get way more publicity and is what is taught in the 10th grade textbooks.[/supply]

It's been a long while since I bothered to read about these differing economic schools, but I'm willing to guess that supply siders are still considered imbeciles who have about as much of a chance of being Nobel Laureates as Trump has of being awarded the Presidential Medal of Freedom after he leaves office.

Unlike you, being able to buy stuff at a shitty supermarket after 10pm isn't on my list of things that make a town worth living in. The types of supermarkets that open 24 hours generally have crap I wouldn't buy.As to your point about Wal-mart, I bet there were a lot of people in those rural towns that liked they could get their goods at 9-10pm at night. Mom and pop places don't stay open that late and usually don't have near the selection Wal-mart would. Stop being so short sighted.

And it's apparent that you offer nothing useful to say with regards to the lots of people in rural towns that have to travel 30+ minutes into nearby towns to do their shopping because Walmart packed up and left after driving their local mom/pop places out of business.

Reply With Quote

Reply With Quote